Executive Summary

The American Cable Association (ACA), the trade association that represents cable systems that compete with Comcast, is calling on the U.S. Department of Justice (DOJ) to “immediately open an investigation” into the 2011 acquisition of NBC Universal (NBCU) by Comcast. ACA claims that “the vertically integrated Comcast-NBCU poses a much greater threat to competition in markets across the country than the AT&T-Time Warner combination (AT&T-TW) that was just consummated.” DOJ, along with the Federal Communications Commission, did in fact investigate and challenge the Comcast/NBCU transaction in 2011, and the merger was allowed to proceed subject to a series of behavioral restrictions imposed by the FCC. These behavioral restrictions expired at the end of 2017.The American Cable Association (ACA), the trade association that represents cable systems that compete with Comcast, is calling on the U.S. Department of Justice (DOJ) to “immediately open an investigation” into the 2011 acquisition of NBC Universal (NBCU) by Comcast. ACA claims that “the vertically integrated Comcast-NBCU poses a much greater threat to competition in markets across the country than the AT&T-Time Warner combination (AT&T-TW) that was just consummated.” DOJ, along with the Federal Communications Commission, did in fact investigate and challenge the Comcast/NBCU transaction in 2011, and the merger was allowed to proceed subject to a series of behavioral restrictions imposed by the FCC. These behavioral restrictions expired at the end of 2017.

These complaints about Comcast by ACA are not new. Over a year ago, ACA alleged that the Comcast/NBCU merger forced its members to pay prices for NBCU programming that had to be passed on as higher fees to final customers, and the AT&T/Time Warner merger will do the same. Of course, the American Cable Association members sometimes are competitors of Comcast as well as AT&T’s DirecTV and other programming distributors like Hulu, so even though these claims allege potential harm to consumers, antitrust analysis as a general rule requires that competitor complaints be viewed skeptically.

But even to the extent the complaints about Comcast using NBCU for an anticompetitive advantage are not self-serving competitor complaints, a new DOJ investigation of the Comcast/NBCU transaction faces several significant problems that make any new legal challenge to the Comcast/NBCU combination unlikely to succeed.

Changes in the market give Comcast even less leverage over its rivals than it may have had in 2011. These changes were evident as early as 2014, when Comcast attempted to use The Weather Channel, one of the NBCU channels, for leverage over DirecTV. Rather than give in to Comcast’s demands, DirecTV dropped the channel and replaced it with other weather content until Comcast folded and agreed to the lower rate DirecTV wanted. Comcast’s failure to raise the price of an NBCU channel only three years after the NBCU acquisition is an example of how concerns about vertically-integrated programming and distribution companies using the purported leverage from channels they control for anticompetitive purposes has been overblown in cases brought by DOJ.

Importantly, the market has become even more innovative and dynamic in other ways since the 2011 Comcast/NBCU merger. Consumers have more choices than ever before for receiving programming content and are now far more willing to “cut the cord” and choose various Internet platforms for receiving information and entertainment. There is a strong trend toward making the most valuable programming content available in many different ways. For example, HBO channels can be purchased as a premium service from cable and satellite providers, as well as through the online SlingTV and Hulu services. The HBO Now app is currently pre-loaded on all Apple TVs for users of iPhones and iPads, and similar apps can be uploaded to Android, Amazon Fire, and Kindle devices.

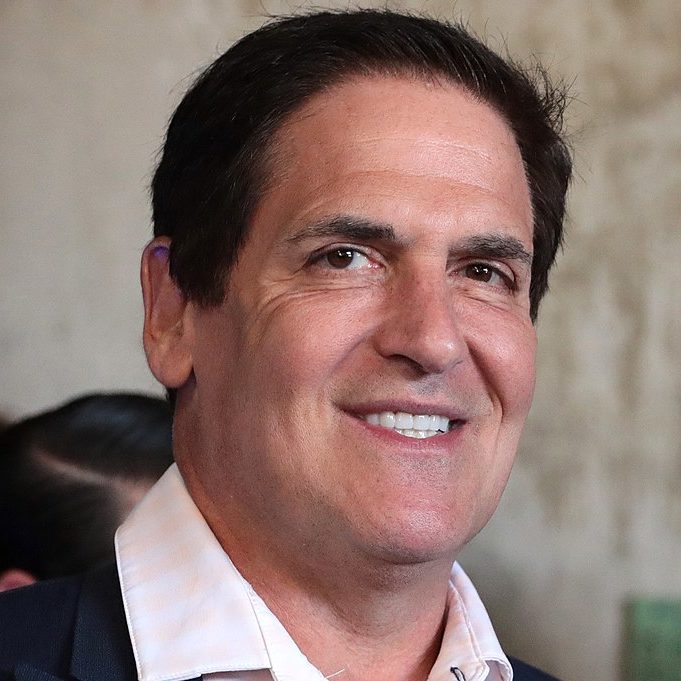

Indeed, web giants Facebook, Amazon, and Google are major purveyors of online video content. As Mark Cuban recently declared:

The idea that TV is the dominant content delivery mechanism no longer is valid. Instead, we fill our time by consuming content from Facebook, Instagram, Snapchat, Messenger, WhatsApp and slowly from Virtual Reality companies like Occulus Rift. Combined, these apps reach more than 1.5 billion users a month. They can deliver any kind of content, in any manner the consumer would like to receive it, be it message, video, VR, post, ad, you name it, to populations around the world in a manner that dwarfs TV.

In short, anticompetitive strategies that might have worked in the past – perhaps even the recent past – will not be as profitable today, due to the increase in consumer choices and the likely losses of subscribers to other distribution platforms. For several years now, traditional multichannel video distributors like Comcast have witnessed declines in their subscriber numbers.

And DOJ’s options for relief are limited by the positions it took during the AT&T/Time Warner merger and by statements made by the current Assistant Attorney General expressing strong skepticism about the value and efficacy of behavioral relief of the type imposed by the FCC in 2011. Were DOJ to pursue antitrust relief from Comcast, it will have a difficult time explaining why it is taking a position that is hard to reconcile with another recent position involving vertical integration of programming producers and distributors.

President Trump has also tweeted, evidently supportively, about ACA’s accusation that Comcast is violating antitrust laws. While the President is not calling on DOJ to investigate Comcast, if DOJ were to initiate an investigation of Comcast, this tweet might lend credence to claims that it is acting under pressure from President Trump. AT&T and Time Warner earlier had alleged that DOJ’s review of their transaction was unduly influenced by the President’s political considerations. While there is no actual evidence that DOJ’s decisions regarding the AT&T/Time Warner litigation were motivated by improper political considerations, the President’s comments regarding Comcast puts DOJ in a similar awkward position if it decides to pursue an investigation of Comcast today.

Most significantly, strong market evidence points to DOJ having a much weaker case against a Comcast/NBCU combination today than it had in 2011. DOJ has no compelling reason to revisit this 2011 transaction, and can avoid further questions about its investigations into programming distribution being politically motivated by deploying its investigative resources elsewhere.

The 2011 Combination of Comcast and NBCU

After several months of negotiations, Comcast agreed in late 2009 to acquire control of NBC Universal (NBCU) from its parent company, the General Electric Company (GE). The purpose of the transaction was to form a programming joint venture with Comcast owning a controlling 51 percent interest and GE owning 49 percent. The joint venture would consist of the channels owned by Comcast and NBC, plus Universal Studios, and Comcast agreed to pay GE an additional $6.5 billion.1Tim Arango, “G.E. Makes It Official: NBC Will Go to Comcast,” The New York Times (December 3, 2009), available at: https://www.nytimes.com/2009/12/04/business/media/04nbc.html. NBCU at the time consisted of NBC, Universal Studios (including its film library), and its cable channels, including Bravo, CNBC, MSNBC, Syfy, The Weather Channel, and USA. The channels contributed by Comcast included E Entertainment, the Golf Channel, Versus, and its regional sports channels.

Although this transaction involved the horizontal combination of programming channels, the NBC channels were much more significant than the Comcast channels. Thus, the transaction was mostly evaluated as a vertical combination, with NBCU providing the programming content and Comcast distributing that content. Comcast at the time was one of the leading multichannel video programming distributors (MVPDs) in the United States, and online video distributors (OVDs) were not yet significant players in programming distribution.

The Comcast/NBCU transaction was challenged by both the Federal Communications Commission and the U.S. Department of Justice. DOJ challenged the transaction under Clayton Act standards, which focus on the economic effects of the combination. DOJ found that the transaction violated the Clayton Act and settled its complaint with a consent decree.2See Complaint, United States v. Comcast Corp., No. 1:11-cv-00106 (D.D.C. Jan. 18, 2011), available at http://www.justice.gov/atr/cases/f266100/266164.pdf, and Competitive Impact Statement, United States v. Comcast Corp., No. 1:11-cv-00106 (D.D.C. Jan. 18, 2011), available at http://www.justice.gov/atr/cases/f266100/266158.pdf. Since the joint venture involved the transfer of broadcast licenses, it was also reviewed by the FCC under its “public interest” standard, which allows the FCC to consider factors other than competitive effects.3Some of the factors the FCC has considered in the past under its vague “public interest” standard have included “whether the transaction would protect service quality for consumers, accelerate private sector deployment of advanced telecommunications services, ensure diversity of information sources and viewpoints, [and] increase the availability of children’s programming and Public, Educational, and Government programming.” Alexander Maltas, Tony Lin, and Robert F. Baldwin III, “A Comparison of the DOJ and FCC Merger Review Processes: A Practitioner’s Perspective,” The Antitrust Source (August, 2016), at 2, available at: https://www.americanbar.org/content/dam/aba/publishing/antitrust_source/aug16_maltas_8_5f.authcheckdam.pdf. In January 2011, the FCC issued an order that allowed Comcast and GE to form the programming joint venture, subject to a series of restrictions based on competition concerns and other “public interest” considerations.4Federal Communications Commission, “Memorandum Opinion and Order, Applications of Comcast Corporation, General Electric Company, and NBC Universal, Inc. for Consent to Assign Licenses and Transfer Control of Licensees,” MB Docket No. 10-56, FCC 11-4 (January 20, 2011) (hereafter, the “FCC’s 2011 Order”), available at https://www.fcc.gov/document/applications-comcast-corporation-general-electric-company-and-nbc-1. Two years later, in February 2013, Comcast bought out GE’s interest in the joint venture, leaving Comcast as the sole owner of the programming produced by NBCU.5Liana Baker, “GE to Sell Rest of NBC Stake to Comcast for $16.7 Billion,” Reuters (February 12, 2013), available at: https://www.reuters.com/article/us-ge-nbc-idUSBRE91B1IM20130212.

The Restrictions on Comcast Under the FCC Order

The FCC required a series of conditions for the Comcast/NBCU transaction, which were all behavioral conditions. 6For a brief summary of these conditions, see Julia Boorstin, “FCC & DOJ Approve Comcast-NBC Universal Deal with Conditions,” CNBC (January 18, 2011), available at: https://www.cnbc.com/id/41139507. Specifically, the FCC prohibited Comcast (as both the controlling party in the joint venture and later as sole owner of the NBCU content after the GE buyout) from discriminating between its own content and services and the content and services of other companies.7FCC’s 2011 Order, pg. 3, ¶4. The FCC also required that Comcast agree to arbitration with MVPDs to resolve disputes about prices, terms, and conditions for licensing Comcast-NBCU’s video programming.8Id., pp. 3-4, ¶4.

Even though Online Video Distributor (“OVD”) competition was in a nascent stage, the FCC required that Comcast offer its programming to OVDs at the same terms and conditions that would be available to cable or satellite TV systems. The FCC also required that Comcast offer “standalone broadband Internet access services at reasonable prices and of sufficient bandwidth so that customers can access online video services without the need to purchase a cable television subscription from Comcast.”9Id., p. 3, ¶4. It also limited Comcast’s managerial control over Hulu, the online streaming service in which Comcast has a minority interest.10Id.

The FCC’s 2011 Order contained several other provisions that the FCC could impose under its public interest standard, but likely would not have been allowed under DOJ’s Clayton Act standards. They include requirements that Comcast offer high-speed Internet at discounted prices to low-income households; that Comcast offer programming that meets certain minimum requirements for local content, diversity, and children’s content; and that Comcast introduce new on demand and online platforms for public, educational, and governmental content.11Id., p. 5, ¶6. Notably, all of these FCC conditions expired on December 31, 2017.12Id., p. 141. The DOJ consent decree expired at the same time as the FCC Order.13Competitive Impact Statement, United States v. Comcast Corp., No. 1:11-cv-00106 (D.D.C. Jan. 18, 2011), at 41. Thus, Comcast is no longer subject to the behavioral restrictions imposed by the FCC and DOJ.

Calls for DOJ to Revisit the 2011 Comcast/NBCU Transaction

Probably the leading group asking DOJ to investigate the business practices of Comcast since the end of the FCC’s behavioral conditions is the American Cable Association (ACA), the trade association that represents small- to mid-size cable systems that sometimes compete with Comcast and other broadband providers. ACA sent a letter to Assistant Attorney General Makan Delrahim in early November of 2018 alleging:

[T]he vertically integrated Comcast-NBCU poses a much greater threat to competition in markets across the country than the AT&T-Time Warner combination (AT&T-TW) that was just consummated, especially because Comcast-NBCU has a combination of cable systems, an NBCU Owned and Operated station, and a Regional Sports Network in seven markets — up from six in 2011. Further, Comcast-NBCU has shown a willingness to harm rivals, even while being subject to the 2011 DOJ and FCC conditions. In light of these concerns, which also have been expressed by members of Congress and a diverse array of stakeholders, the Antitrust Division should immediately open an investigation into the firm’s behavior. ACA and its members will cooperate fully to assist in the investigation, including by providing information about Comcast-NBCU’s practices.1American Cable Association, Letter to Assistant Attorney General Makan Delrahim, p.1, available at: http://www.americancable.org/wp-content/uploads/2018/11/181106-DOJ-Letter-re-Comcast-NBCU-w-AppendixFINAL.pdf.

ACA is comparing the 2011 Comcast/NBCU merger to the more recent AT&T/Time Warner merger because both are primarily vertical combinations of programming content providers and programming distributors. AT&T, like Comcast, is a major programming distributor through its DirecTV satellite service and its U-Verse service over its AT&T fiber, while Time Warner, like NBCU, is primarily a media and entertainment content provider.14Time Warner owns CNN (multiple channels), HBO (multiple pay channels), the Turner Broadcasting System (TBS, TNT, truTV, TCM, Cartoon Network, Boomerang, Turner Sports, et.al.), Warner Brothers (Warner Brothers Pictures, Warner Brothers Theaters, Warner Brothers Television Group, DC Comics, and other assets), shares of several joint ventures (e.g., NBA Digital, including NBA League Pass, 10% of Hulu), and other assets. Time Warner does not include Time Warner Cable, a horizontal competitor of DirecTV. Time Warner sold its cable operations in 2009. “Time Warner Cable Separation Information,” Time Warner, Inc. (visited November 16, 2018), available at: http://ir.timewarner.com/phoenix.zhtml?c=70972&p=irol-twcseparation. Time Warner Cable was later acquired by Charter Communications, which has rebranded it as Spectrum in many markets. Time Warner also spun off Time, Inc., the magazine company that publishes the magazines Time and Fortune, among others, in 2014. “Time Warner Inc. Completes Spin-Off of Time Inc.” (Press Release, June 9, 2014), available at: http://www.timewarner.com/newsroom/press-releases/2014/06/09/time-warner-inc-completes-spin-off-of-time-inc.

ACA expects – and there is every reason for DOJ to expect – Comcast-NBCU to act on its natural incentives and use its capabilities to harm rivals, unless the government somehow, either through structural or behavioral remedies, deals with them. ComcastNBCU, in fact, took many opportunities to exercise its market power even though the DOJ and FCC conditions were in effect, supposedly limiting Comcast-NBCU’s behavior. For instance, Comcast-NBCU used its deep pockets to engage in delaying tactics that forestalled compliance with the condition that it carry Bloomberg TV. Comcast also refused to offer standalone broadband Internet access service as the FCC condition required. And, of course, we do not even know how many times Comcast’s rivals had to threaten to utilize the arbitration or some other condition to get Comcast-NBCU to limit to some degree its natural proclivity to harm rivals. At least, with conditions in place, some of these abuses could be addressed.

Now, however, without any conditions, Comcast-NBCU can act with impunity, and DOJ should expect this to happen. For example, Comcast-NBCU may already be wielding a new weapon against its rivals – Hulu. We have heard from ACA members that they fear that Comcast-NBCU may restrict, if it is not already restricting, their ability to access Hulu and make it available to their customers as an alternative to their cable offerings. This is especially troubling because their customers increasingly seek over-the-top options to prime offerings. As you noted in your recent Senate testimony, “Hulu could be a competitor to the cable business, and it’s one that we will examine carefully to see if they might take any conduct that would harm its ability to compete within their market.”2Id., pp. 4-5 (citations omitted).

The ACA goes on to explain the specific conduct they allege Comcast engaged in that is anticompetitive:

The claim that Comcast can use Hulu as a weapon against competing cable systems is particularly dubious. Comcast today owns only a minority interest in Hulu, and its control over the management of Hulu may soon be greatly reduced. Comcast, Disney, and Fox each own 30 percent of Hulu, while AT&T owns 10 percent through its acquisition of Time Warner. Disney has entered into an agreement to acquire Fox, which would give Disney majority control of Hulu, and it appears likely that Comcast is looking to sell its interest in Hulu.15Daniel Frankel, “Comcast Ready to Sell 30% Hulu Stake to Disney, Report Says?” Multichannel News(September 24, 2018), available at: https://www.multichannel.com/news/comcast-ready-to-sell-30-hulu-stake-todisney-report-says.

The ACA concludes by pointing out that other parties have called on the DOJ to investigate Comcast:

Finally, ACA is not alone in raising concerns that Comcast-NBCU will harm consumer welfare and asking the DOJ to initiate an investigation. Last December, Senator Blumenthal called on you to open such an investigation and to petition the U.S. District Court to maintain the 2011 conditions. Former FCC Commissioner Mignon Clyburn later joined with Sen. Richard Blumenthal of Connecticut to again express these concerns. The consumer organization, Public Knowledge, also wrote you, echoing the Senator’s concerns and his request for an investigation. More recently, groups for other parts of the political spectrum, such as Americans for Limited Government and the National Grange, have publicly announced their concerns about Comcast-NBCU’s anticompetitive conduct and calling for you to intervene. This wideranging concern attests to the grave harm that Comcast-NBCU can inflict on consumers and rivals and should give you additional reason to engage and investigate.3American Cable Association, Letter to Assistant Attorney General Makan Delrahim, p. 5 (citations omitted)

In response to a report from Fox Business Network’s Charles Gasparino about the ACA’s letter, President Donald Trump tweeted, evidently supportively, that the trade group is accusing Comcast of violating antitrust laws:’

American Cable Association has big problems with Comcast. They say that Comcast routinely violates Antitrust Laws. “These guys are acting much worse, and have much more potential for damage to consumers, than anything AT&T-Time Warner would do.” Charlie Gasparino.4David Harris, “DOJ Should Investigate Comcast-NBCU Over Alleged Antitrust, Lobbying Group Says,” CRN (November 12, 2018), available at: https://www.crn.com/news/channel-programs/doj-should-investigate-comcastnbcu-over-alleged-antitrust-lobbying-group-says.

While the President is not calling on DOJ to investigate Comcast, if DOJ were to initiate an investigation of Comcast, this tweet may lend credence to claims that it is acting under pressure from President Trump. AT&T and Time Warner earlier had alleged that DOJ’s review of their transaction was unduly influenced by the President’s political considerations and asked the court for access to communications between the White House and the Justice Department about the takeover16.See, e.g., David McLaughlin, Scott Moritz, and Sara Forden, “AT&T Ready to Probe the White House’s Role in Time Warner Deal, Bloomberg (November 13, 2017), available at: https://www.bloomberg.com/news/articles/2017-11- 13/at-t-is-said-ready-to-probe-white-house-role-on-time-warner-deal. There is no actual evidence that the decisions made by DOJ regarding the AT&T/Time Warner litigation were motivated by improper political considerations.17Others have made such allegations. For example, former Representative Silvestre Reyes (D-TX), called for an investigation of whether there was any improper influence by the President. “The White House May Be Interfering in an AT&T and Time Warner Deal for Political Gain,” The Hill (November 18, 2017), available at: http://thehill.com/opinion/technology/361010-the-white-house-may-be-interfering-in-an-att-and-time-warner-dealfor. (“The merger between AT&T and Time Warner may or may not be a good deal for the American people. However, there is a possibility that the White House and the Department of Justice may have acted out of political payback against CNN and to potentially help their ally Rupert Murdoch acquire the cable network. In the interest of justice and transparency, an investigative unit of the federal government must get to the bottom of this matter immediately.”) Even so, given that the DOJ case was questionable in the first place18See, e.g., Theodore R. Bolema, “The Proper Context for Assessing the AT&T/Time Warner Merger,” Perspectives from FSF Scholars, Vol. 13, No. 6 (February 8, 2018), available at: http://www.freestatefoundation.org/images/The_Proper_Context_for_Assessing_the_AT_TTime_Warner_Merger_020818.pdf. and, in my view, its appeal unlikely to succeed,19Theodore R. Bolema, “The DOJ’s Rather Unusual AT&T/Time Warner Merger Appeal,” Perspectives from FSF Scholars, Vol. 13, No. 39 (October 18, 2018), available at: http://www.freestatefoundation.org/images/The_DOJ_s_Rather_Unusual_AT_TTime_Warner_Merger_Appeal_101818.pdfhttp://www.freestatefoundation.org/images/The_DOJ_s_Rather_Unusual _AT_T-Time_Warner_Merger_Appeal_101818.pdf. the President’s comments regarding Comcast puts DOJ in a similar awkward position if it decides to pursue an investigation of Comcast today. But even putting political considerations aside, a new DOJ investigation of the Comcast/NBCU transaction faces several significant problems that will make any new legal challenge to the Comcast/NBCU combination unlikely to succeed. First, the complaining parties in the ACA are competitors of Comcast, so their complaints are likely to be viewed skeptically as self-serving. Second, the most prominent example of Comcast trying to use an NBCU channel for leverage over a rival failed badly, for reasons unrelated to the FCC’s 2011 Order. Third, the market has changed significantly since 2011 in ways that give Comcast even less leverage over its rivals than it may have had in 2011. And fourth, DOJ’s options for relief are limited by the positions it took during the AT&T/Time Warner merger and by statements made by the current Assistant Attorney General expressing strong skepticism about the value of behavioral relief of the type imposed in the FCC’s 2011 Order.

Harm to Competition v. Harm to Competitors

These complaints about Comcast by the ACA are not new. Over a year ago, the ACA alleged that the Comcast/NBCU merger forced its members to pay prices for NBCU programming that had to be passed on as higher fees to final customers, and the AT&T/Time Warner merger will do the same.20Jon Brodkin, “Comcast Found a Way to Raise Other Cable Companies’ Prices, Rivals Say,” ARSTechnica(October 12, 2017), available at: https://arstechnica.com/tech-policy/2017/10/comcast-found-a-way-to-raise-othercable-companies-prices-rivals-say/. Of course, the American Cable Association members are competitors of DirecTV and U-Verse and other programming distributors like Hulu, so even though these claims describe potential harm to consumers, antitrust analysis as a general rule requires that competitor complaints be viewed skeptically.

The Clayton Act standards for reviewing mergers focus on harm to competition, which is not the same as harm to competitors – despite what competitors would like to think. The Clayton Act is intended to encourage mergers that have pro-competitive effects because then the merged company can better serve its customers, even if that may also harm competitors who find it more difficult to compete with a more economically efficient rival. The latter is not a harm to competition, however, and would not be recognized as an antitrust harm under the Clayton Act.

In horizontal mergers that violate the Clayton Act, the injured parties will usually be the downstream customers or the upstream suppliers of the merging companies. Since they compete on different levels from the merging companies, it is usually fairly easy for a court to distinguish between harm to competition and harm to competitors. As a general rule, if customers or suppliers are being harmed by a horizontal merger, that probably indicates harm to competition, but if horizontal competitors are being harmed, that usually means the merger is pro-competitive on balance.

In vertical mergers, distinguishing between harm to competition and harm to competitors can be much more difficult. Some customers may be fully downstream from the merging parties, and some suppliers may be fully upstream, so their claims of harm can be analyzed much the same as the claims of harm alleged by customers or suppliers in a horizontal merger case. More typically, however, the alleged harms due to a vertical merger will be at the same level in the supply chain as at least one of the merging parties.

Much of the government’s case when challenging a vertical merger is made through the complaints and evidence brought by parties who say they are being harmed by the merger. In such cases, the government and the court face the additional challenge of having to sort out why such parties claim to be harmed. Complaints from parties who are horizontal competitors must then be viewed with some skepticism by any court, because they may well be complaining about being harmed by having to face a stronger and more efficient competitor after the merger. Indeed, one of the reasons Judge Richard Leon gave for dismissing complaints from the “hot documents” provided by DOJ to support its case against the AT&T/Time Warner merger was that many of them were from self-serving regulatory filings where a potential outcome for the commenting party was that it would gain an advantage over competitors.21United States v. AT&T Inc., DirecTV Group Holdings, LLC, and Time Warner Inc. (D.D.C., 2018), No. 1:17-cv02511-RJL, at 81-90, available at https://ecf.dcd.uscourts.gov/cgi-bin/show_public_doc?2017cv2511-146.

But even to the extent the complaints about Comcast using NBCU for an anticompetitive advantage are not self-serving competitor complaints, there are other reasons to believe a new antitrust challenge to the combination today is likely to fail.

Programming Today Is a Questionable Source of Leverage

Video content consumers currently have far more programming content available to them than ever before. Cable systems today offer hundreds of channels, and Internet-based distributors like Amazon Prime, Hulu, and Netflix are offering original content of their own. As a result, no particular channels, including the NBCU channels, have the same value that they once had. That means that any threats or actions to withhold channels from competing programming distributors will be less effective than they might have been a few years ago.

The 2014 dispute between Comcast and DirecTV over The Weather Channel (TWC) illustrates how content providers have less leverage than in the past. Comcast announced that it was raising its rates for TWC and DirecTV balked at the rate increase. When no agreement was reached, DirecTV dropped TWC in January of 2014. TWC responded with public statements and newspaper ads, among other actions, encouraging DirecTV customers to drop their DirecTV service and complaining that DirecTV would not waive early termination fees for customers who terminated their DirecTV service due to losing access to TWC.22Cynthia Littleton, “Weather Channel Blasts DirecTV On Termination Fees,” Variety (January 22, 2014), available at: http://variety.com/2014/tv/news/weather-channel-blasts-directv-on-termination-fees-1201066522/.

Notably, this dispute took place three years after Comcast acquired TWC, so Comcast arguably was using TWC for leverage after a vertical merger to place competing content distributors at a disadvantage – the very type of anticompetitive conduct described in the DOJ’s 2011 Complaint23Complaint, United States v. Comcast Corp., No. 1:11-cv-00106 (D.D.C. Jan. 18, 2011), at 3-4, available at http://www.justice.gov/atr/cases/f266100/266164.pdf. and which DOJ claimed the Consent Decree would address.24Competitive Impact Statement, United States v. Comcast Corp., No. 1:11-cv-00106 (D.D.C. Jan. 18, 2011), at 3, available at http://www.justice.gov/atr/cases/f266100/266158.pdf. (“The proposed Final Judgment will provide a prompt, certain, and effective remedy for consumers by diminishing Comcast’s ability to use the JV’s programming to harm competition.”) Applying the theory from the Complaint (which is also the theory DOJ asserted in its recent challenge to the AT&T/Time Warner merger), Comcast would have more incentive to raise rates for TWC and other NBCU channels after the merger, because some of the lost revenues if DirecTV dropped its channel would be made up when a portion of DirecTV’s customers who wanted that channel switched to Comcast.

DirecTV possibly may have had an argument that Comcast’s conduct regarding TWC violated the FCC’s 2011 Order. But DirecTV took a different approach to defeat Comcast’s attempt to raise prices. DirecTV replaced TWC in its channel lineup with Weather Nation, a start-up rival to TWC. After three months, Comcast folded and agreed to a lower rate for TWC. TWC also agreed to change its programming to emphasize more weather and less reality shows, in response to demands from DirecTV.25Ryan Faughnder and Joe Flint, “DirecTV and Weather Channel Ink Carriage Deal, Ending Dispute,” Los Angeles Times (April 8, 2014), available at: http://articles.latimes.com/2014/apr/08/entertainment/la-et-ct-directv-weatherchannel-deal-20140408.

Of course, consumers value some programming more than other programming, so other channels may give a vertically-integrated company more leverage than The Weather Channel gave Comcast in 2014.26Comcast sold The Weather Channel to Entertainment Studios in 2018. Mike Snider, “The Weather Channel Sold to Independent Entertainment Studios,” USA Today (March 23, 2018), available at: https://www.usatoday.com/story/money/media/2018/03/23/weather-channel-sold-independent-entertainmentstudios/452202002/. Still, Comcast’s failure to raise the price of TWC after its NBCU acquisition is an example of how this leverage has been overrated in cases brought by DOJ.

Moreover, the DOJ’s attempt to show how the Time Warner programming would give AT&T such leverage over competing programming distributors fell flat at the recent AT&T/Time Warner trial. Judge Richard Leon made it clear near the beginning of his opinion that he recognized that vertical mergers can have anticompetitive effects.27United States v. AT&T Inc., DirecTV Group Holdings, LLC, and Time Warner Inc., at 6 (“A merger combining a manufacturer with the leading supplier of a key input, for example could allow the combined company to increase the price of the input to the rival manufacturers, raising their costs. Once that company raised its rivals’ costs, it could then raise its own price or increase its market share at its rivals’ expense (citations omitted)”). Thus, the question before Judge Leon was whether the anticompetitive harm DOJ could demonstrate was enough to outweigh the efficiency benefits.28Judge Leon pointed out that the DOJ’s main economics witness, Dr. Carl Shapiro, agreed that this is the test the district court was to use when he wrote: “to understand whether the proposed merger will harm consumers, Professor Shapiro explained, it is necessary to ‘balance’ whether the government’s asserted harms outweigh the merger’s conceded benefits.” Id., at 68. After examining in great detail the economic model and inputs used by DOJ’s main economic witness, Dr. Carl Shapiro, the conclusion reached by Judge Leon was fatal to the DOJ’s case against the merger:

[T]he evidence at trial showed that Professor Shapiro’s model lacks both reliability and factual credibility and thus fails to generate probative predictions of future harm associated with the Government’s increased leverage theory. Accordingly, neither Professor Shapiro’s model, nor his testimony based on it, provides me with an adequate basis to conclude that the challenged merger will lead to any raised costs on the part of distributors or consumers – much less consumer harms that outweigh the conceded $350 million in annual cost savings to AT&T’s customers.5Id., at 149 (emphasis in original, citations omitted)

DOJ would likely face the same problems in proving anticompetitive harm in any case it brings against Comcast over using NBCU channels for an anticompetitive advantage. Whether the Comcast/NBCU combination content gives Comcast any anticompetitive advantage is questionable and difficult to prove even if such evidence exists. But even if DOJ could prove anticompetitive harm, it will also have to show that this harm is not outweighed by efficiency benefits that enhance consumer welfare. Just as Dr. Shapiro conceded at trial that there were at least some positive efficiency benefits from an AT&T/Time Warner merger, the FCC found in 2011 that there were at least some positive efficiency benefits from the Comcast/NBCU transaction, although the FCC disagreed with the parties about the magnitude of these benefits.29Some of the efficiency benefits the FCC acknowledged in 2011 from the Comcast/NBCU combination include: “(1) claims that the combination would enhance prospects for innovation by reducing the transactions costs associated with coordinating content development with the development of new forms of media distribution; (2) cost savings said to arise from the elimination of the double marginalization of programming costs; and (3) cost reductions claimed to result from increased economies of scale and scope.” Jonathan B. Baker, “Comcast/NBCU: The FCC Provides a Roadmap for Vertical Merger Analysis,” Antitrust, Vol. 25 No. 2 (Spring, 2012), at 38, available at: https://transition.fcc.gov/osp/projects/baker_vertical_mergers.pdf. The FCC found these general vertical merger efficiency benefits “to be plausible in principle, but in some respects speculative, overstated, or unsubstantiated.” Id.

In any event, the video content and distribution markets and technology are much different now than in 2011, when the Comcast/NBCU merger was settled. Since then, the video market clearly has become even more dynamic, with consumers becoming far more willing to “cut the cord,” that is, to discontinue their subscriptions with a traditional cable or satellite distributor and use Internet platforms like Hulu, Netflix, Vudu, or Youtube for their information and entertainment services.

Consumers Have Much More Choice in the Content Distribution Market Today

As late as the early 1990s, the choice for most consumers was between one cable system and over-the-air television services received via their local antenna. In the 1990s, important competition emerged in the form of satellite television services. After the market for small dish satellite services shook out, for approximately the last 20 years the two major satellite services have been DirecTV, now owned by AT&T, and Dish Network, owned by Echostar. Most consumers could then choose between their local cable provider and two satellite services. Today, however, anyone with an Internet connection, whether fixed or wireless, has many more choices than that for receiving video content.

Data contained in the FCC’s Eighteenth Video Competition Report (“Eighteenth Report”) clearly describes a dynamic video market in which video distribution is becoming more competitive as innovative new forms of distribution are emerging and even beginning to overtake more traditional distribution channels. The report, the most recent of its kind by the FCC, categorizes video distribution services into three groups – multichannel video programming distributors (MVPDs), broadcast television stations, and online video distributors (OVDs).30Annual Report of the Status of Competition in the Market for the Delivery of Video Programming, Eighteenth Report (Eighteenth Report), MB Docket No. 16-247 (January 17, 2017), available at: https://apps.fcc.gov/edocs_public/attachmatch/DA-17-71A1_Rcd.pdf.

Traditional MVPD services have been in decline for several years. The Eighteenth Report finds that: “Total MVPD subscribers declined in 2013, 2014, and 2015. MVPDs lost about 1.1 million video subscribers in 2015. Specifically, cable MVPDs lost 599,000 subscribers and DBS [satellite] MVPDs lost 477,000 subscribers.”31Id., at p. 3, ¶5 (internal citations omitted). The Report also finds that at the end of 2015, cable accounted for 53.1 percent of all MVPD subscribers, down from 53.4 percent at the end of 2014. Satellite providers (DirecTV and Dish Network) accounted for 33.2 percent of MVPD subscribers at the end of 2015, slightly down from 33.3 at the end of 2014. Most of the rest were telephone company MVPDs, including U-Verse.32Id., at p. 8, ¶19.

Additionally, the Eighteenth Report identified the increasing popularity and growth of online video distributor (OVD) services:

SNL Kagan projects that by the end of 2016, 65 million households will subscribe to at least one OVD service and collectively they will purchase 109.0 million subscriptions to OVD services. Netflix had 46 million subscribers at the end of the second quarter of 2016, up from 41.1 million subscribers in second quarter of 2015. Hulu had 11.3 million subscribers at the end of second quarter 2016, up from 9.3 million in second quarter of 2015. Amazon Prime reported 63 million subscribers, all of whom receive free access to Amazon Video, in the second quarter of 2016. Four out of five Amazon Prime subscribers use Prime Video and 40 percent of Amazon Prime subscribers used Prime Video at least weekly. Many households subscribe to more than one OVD. For example, roughly 38 percent of Netflix subscribers also subscribe to Amazon Prime and 25 percent of Netflix subscribers also subscribe to Hulu.6Id., at p. 26, ¶63 (internal citations omitted)

New OVD entrants and services are being launched at a rapid pace. For example, T-Mobile acquired Layer3 earlier this year, which provides cable and Internet services in Washington, DC, and several other markets, to launch “a disruptive new TV service” that will “bring real choice to consumers across the country.”33Michael Sheetz, “T-Mobile Announces Acquisition of Layer3 TV, Says It Plans to Launch ‘Disruptive New TV Service’ in 2018,” CNBC (December 13, 2017), available at: https://finance.yahoo.com/m/bfd4ddb8-1a03-3392-af19-d647cacb3210/t-mobile-announces.html.

It should also be noted that most OVD entrants start out with an important advantage over cable MVPD providers. A cable system is limited geographically by the physical reach of its wires. Most OVD services are distributed over Internet or broadband wireless connections, so they are available anywhere that has Internet service34.See, e.g., Eighteenth Report, at pg. 52-53 (“In contrast to a traditional MVPD, whose service area typically is tied to the provider’s own facilities-based infrastructure, or a broadcaster, whose service area typically is defined by the station’s signal coverage area and DMA, an OVD’s geographic service area potentially covers all regions capable of receiving high-speed Internet service. Consumers can access online video via multiple Internet-enabled devices, including computers, smartphones, tablets, gaming consoles, television sets, and other equipment (citations omitted)”). For this reason, entry is easier for many OVD services, because most of their infrastructure needs are being met by other services.

Free State Foundation scholars have taken the position that traditional MVPD services and OVD services should be considered substitutes.35See, e.g., Randolph May and Seth Cooper, “Comments of the Free State Foundation¸” In the Matter of Annual Assessment of the Status of Competition in the Market for the Delivery of Video Programming, MB Docket No. 16-247 (August 21, 2016) (“For its upcoming Eighteenth Video Competition Report, it is time the Commission finally begin taking OVD services seriously as substitutes for MVPD services.”), available at: http://www.freestatefoundation.org/images/FSF_Comments_Assessment_of_the_Status_of_Competition_in_the_M

arket_for_Delivery_of_Video_Programming_092116.pdf The FCC’s Eighteenth Report had not quite, as of January 2017, endorsed the position that MVPD and OVD services are competing in the same market, but it did recognize that they can be substitutes for many customers and provide an important competitive constraint on the pricing and other market conduct of MVPD services:

MVPDs may face increasing competition from OVDs. The interplay between MVPDs and OVDs is wide-ranging and may provide numerous benefits to consumers. For example, MVPD subscribers may be able to (1) cancel MVPD service entirely and substitute content from OVDs, possibly together with over-the-air broadcasters, (2) cancel their subscriptions to premium movie channels and substitute movies from OVDs; or (3) supplement their MVPD programming by adding OVD programming that may not be available from the MVPD. The consideration of substitutes and supplements is important to the analysis of competition in the market for the delivery of video programming because distributors seek to reach viewers, advertising dollars, and subscription revenue. . . .

And because consumers often differ in their video preferences for programming, they often have differing views as to whether an OVD service might be a suitable substitute service for their MVPD service, or simply a different service. Consumers subscribing to both an MVPD and OVDs likely view them as supplements, rather than substitutes.7Eighteenth Report, at pg. 25, ¶59 (internal citations omitted).

But even if MVPD and OVD are not considered to be fully in the same market, the FCC’s conclusion that many consumers subscribing to both an MVPD and OVDs likely view them as supplements rather than substitutes also undermines any claims that Comcast can leverage the NBCU channels for an anticompetitive advantage. With so much programming content already available through many alternative distribution channels, if customers lose access to some content through their current MVPD provider, they now have plenty of alternatives that don’t require switching from their MVPD provider to another programming provider.

Moreover, there is a strong trend toward making the most valuable programming content available in many different ways. For example, HBO channels can be purchased as a premium service from cable and satellite providers, as well as through the online SlingTV and Hulu services. The HBO Now app is currently pre-loaded on all Apple TVs for users of iPhones and iPads, and similar apps can be uploaded to Android, Amazon Fire, and Kindle devices.36Dennis Restauro, “All the Ways to Watch HBO Without Cable,” Grounded Reason (July 7, 2017), available at: https://www.groundedreason.com/watch-games-of-thrones-without-cable/

Finally, just as lines between MVPDs and OVDs are blurring, the video distribution systems described in the FCC’s Eighteenth Report and other technology companies are increasingly finding that they are competing against web-based Internet giants in a broader content delivery market. This point was made by Mark Cuban in his testimony before a Congressional Committee:

The idea that TV is the dominant content delivery mechanism no longer is valid. Instead, we fill our time by consuming content from Facebook, Instagram, Snapchat, Messenger, WhatsApp and slowly from Virtual Reality companies like Occulus Rift. Combined, these apps reach more than 1.5 billion users a month. They can deliver any kind of content, in any manner the consumer would like to receive it, be it message, video, VR, post, ad, you name it, to populations around the world in a manner that dwarfs TV….

Apple, Google, Amazon, MicroSoft, and Facebook are 5 of the 7 most valuable companies by market cap in the world. All have established their dominant positions in the app and content worlds by making important, strategic content acquisitions. That is exactly what the Time Warner acquisition is for AT&T, an important, strategic content acquisition. Alone, it will be very difficult, if not impossible for either AT&T or Time Warner to compete with any of the companies I’ve mentioned. Together it will still be difficult, but a combined entity at least gives them a chance to battle the dominant players in the market.8Peter Kafta, “Mark Cuban Tells Washington to Let AT&T Buy Time Warner, So It Can Compete with Google and Facebook, And Snapchat, and Apple, and Amazon, and Microsoft,” Recode (December 7, 2016), available at: https://www.recode.net/2016/12/7/13868016/mark-cuban-att-time-warner-senate-hearing-facebook-google-amazonapple.

To the extent Comcast/NBCU and AT&T/Time Warner are now competing against these webbased Internet companies, Cuban’s point is essentially that these combinations of content producers and distributors could have a pro-competitive effect by establishing another effective challenger in the broader content delivery market. Thus, in a content delivery market, Comcast and AT&T having the ability to take advantage of efficiencies from combining programming production with programming delivery makes them more effective competitors with little anticompetitive risk as they compete with much larger players.

Structural v. Behavioral Remedies

The calls for DOJ to revisit the 2011 Comcast/NBCU transaction are based in large part on the expiration at the end of 2017 of the FCC’s 2011 behavioral restrictions on Comcast. But if their goal is to get DOJ to reinstate some or most of those behavioral conditions, that runs into a problem with recent positions taken by DOJ on the desirability of behavioral restrictions on merging companies.

Any antitrust investigation has to consider what relief the agency will pursue if it finds a competitive problem. Even if DOJ were to be concerned about Comcast using the NBCU channels for an anticompetitive advantage, the positions AAG Delrahim and DOJ have taken in the past will be a problem for DOJ when devising antitrust relief that might address ACA’s complaints.

Relief in antitrust cases falls into two broad categories: behavioral remedies and structural remedies. Behavioral remedies allow the parties to integrate fully, but then impose certain operating rules on their business behavior aimed at preventing certain potential harms to competition that may result from the merger. The FCC and the parties to the 2011 Comcast/NBCU merger agreed to behavioral remedies to address the concerns raised by the FCC. Having Comcast sell off some NBC channels or Hulu, in contrast, would have been structural relief.

The advantage of behavioral remedies is that they allow the merger to go forward, and generally achieve the resulting efficiency benefits from the merger while imposing restrictions on the conduct of the merged company that may give rise to antitrust concerns. The advantage of structural relief is that, unlike behavioral relief, it does not require ongoing regulatory oversight after the divestiture is completed, although structural relief may prevent some of the efficiency benefits from occurring.

AAG Delrahim has stated that he is skeptical about behavioral conditions and strongly prefers that any relief be structural.37Makan Delrahim, “Assistant Attorney General Makan Delrahim Delivers Keynote Address at American Bar Association’s Antitrust Fall Forum,” (Speech, Washington, DC, November 16, 2017), available at https://www.justice.gov/opa/speech/assistant-attorney-general-makan-delrahim-delivers-keynote-address-americanbar. Consistent with this position, DOJ did not seek behavioral remedies when it challenged the AT&T/Time Warner merger and allegedly tried to settle the challenge with structural relief, such as selling off DirecTV, before it filed its court challenge.38See, e.g., Michelle Fox, “AT&T CEO Stephenson Says He Never Offered to Sell CNN and Is Ready to Litigate Time Warner Deal,” CNBC (November 9, 2017), available at: https://www.cnbc.com/2017/11/09/att-ceo-randallstephenson-i-have-never-been-told-that-the-price-of-getting-a-deal-done-was-selling-cnn.html.

Thus, if DOJ is considering re-investigating the 2011 Comcast/NBCU combination, it faces several hurdles. The DOJ in 2011 found behavioral relief to be sufficient, so the current DOJ will have to explain either why that 2011 position was incorrect or else why it is pursuing behavioral relief from Comcast and structural relief from AT&T’s similar acquisition. If DOJ pursues structural relief from Comcast, its burden is made more difficult by the precedent from the 2018 court ruling against DOJ in the AT&T/Time Warner merger, assuming it is not overturned on appeal. The relevant point from the AT&T/Time Warner decision is that DOJ has to prove its case with actual evidence of specific anticompetitive harm that exceeds the efficiency benefits. No matter which option DOJ chooses, it will have to explain why it is taking a position that is hard to reconcile with another recent position involving vertical integration of programming producers and distributors.

Conclusion

The antitrust arguments against a Comcast/NBCU combination today are much less compelling than they were in 2011. The market has become even more innovative and dynamic since the 2011 Comcast/NBCU merger as consumers are now far more willing to “cut the cord” and look to Internet platforms for information and entertainment, including those of web giants like Amazon, Facebook, and Google. The market changes that gave Comcast even less leverage over its rivals than it may have had in 2011 were clear as early as 2014, when Comcast’s attempt to use one of NBCU’s channels for leverage over DirecTV ended badly for Comcast and did not lead to any anticompetitive harms. In short, anticompetitive strategies that possibly might have worked in the past – perhaps even the recent past – will not be as profitable today, due to the increase in consumer choices and the likely losses of subscribers to other platforms.

DOJ’s options for relief are also limited by the positions it took during the AT&T/Time Warner merger and by statements made by the current Assistant Attorney General expressing strong skepticism about the efficacy and value of behavioral relief of the type imposed in the 2011 FCC Order. DOJ has no compelling reason to revisit this 2011 transaction, and it can avoid further questions about its investigations into programming distribution being politically motivated by deploying its investigative resources elsewhere.